Unveiling the Energy Sector through a Summer Internship

|

by Marcelo Oliveira de Paiva, MBA ’17 and Environmental Finance and Impact Investing Fellow

During my internship on the trading floor of an energy company, I stumbled upon the concept of energy resource reliability and its importance to the energy sector.

The drastic changes that the U.S. energy sector is currently undergoing demands a cross functional skillset from newcomers, as I learned from my internship on the trading floor at large energy company this summer. While I familiarized myself with the motivations of my first assignment, I stumbled upon the concept of reliability of energy resources and learned how critical this topic has become in the industry. Fortunately, Johnson and, more specifically, the Environmental Finance and Impact Investing (EFII) Fellows program, provided me with the knowledge foundation to help me understand the context and complete my task.

My first assignment allowed me to take a glimpse at a hot topic in the energy sector: reliability. Still filled with the excitement of interning in a new industry, specifically, on the trading floor of a large energy company, I was given the task of estimating how much money a determined power plant could lose to penalty payments if it could not execute the necessary energy capacity when needed. In other words, if it was not reliable enough for the system. Not surprisingly, a few questions started popping up in my mind.

Why would this power plant be liable to such penalties?

Reliability of power supply is driving broader actions that bring changes to how the system financially compensates for generation capacity. Independent System Operators (ISOs), entities that ensure reliability and competitiveness in the wholesale electricity market[1], procure construction of new capacity through auctions. In these auctions, ISOs buy future capacity from generators, who commit to place new units up and running. Capacity is no good if it is not generating electricity when needed. Therefore, several ISOs have begun to implement what is called, “pay-for-performance” in which power-generating units would be penalized or compensated for producing below or above their capacity obligation, for example, during power shortages. The genesis of this change is the pursuit of increased system reliability.

What makes this subject a hot issue now?

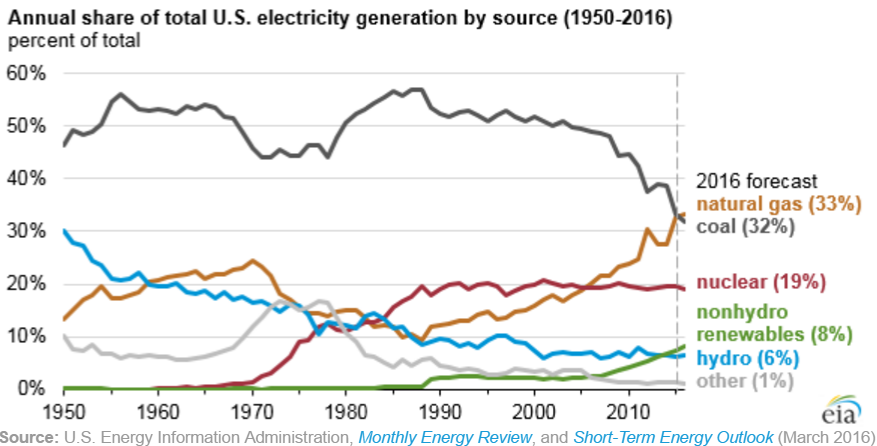

Recently, renewable and natural gas (NG) units have been displacing other energy units that, traditionally, were responsible for the baseload generation. Baseload, the minimum required supply of energy over an entire day[2], has historically been served by coal and nuclear powered units. As environmental regulations have become more stringent, and, more importantly, as NG prices persist at historically low levels, the percentage of coal generation has been declining while NG has been increasing, as depicted on Figure 1.

Figure 1: Annual share of U.S. electricity generation by source (1950-2016)

NG and renewables also affect the economics of nuclear plants and pose challenges to the non-emitting component of baseload. Relatively cheap to operate, NG and renewable units may, in most cases, be the price setters and put downward pressure on electricity prices. Nuclear plants, on the other hand, are usually price takers because they run continuously. In some instances, prices can become even negative as a result of the inability of wind power to control generation during off-peak hours and the effect of subsidies. This dynamic may lead to the early retirement of nuclear plants, as the example of Quad Cities and Clinton in West Illinois[3], and require even larger investments in renewables to compensate for the loss of zero-emission generators while simultaneously meeting emission limits in some states.

How straightforward is the path to cleaner generation?

Despite reliability challenges that still affect renewable sources and NG units, solutions that address these issues may increase availability and relative attractiveness of those units compared to traditional baseload generators. Renewable units, such as solar and wind, still cannot control generation, and storage technologies need further investment and incentives to become viable solutions for the grid[4]. NG units must be connected to a pipeline to receive gas from producers or Liquefied Natural Gas (LNG) from processing plants. During harsh weather conditions, such as the polar vortex in 2014/2015 winter, pipelines can become congested or, in some cases, may freeze, jeopardizing the fuel supply and, consequently, power generation[5]. To increase availability of these resources, solutions may involve more mature storage technologies for renewables, as well as a more diversified fuel portfolio through investment in dual fuel units[6] and in LNG infrastructure for NG powered units.

How fundamental was Johnson to understand this dynamic?

Johnson provided me with knowledge that was crucial to successfully conducting my internship tasks and to gaining a general understanding of how energy markets operate. Throughout my internship, I learned that the deregulated wholesale energy market, where there is no fully vertically integrated utility[7], is a collective of generators that offer electricity through supply curves submitted to their respective ISO, similar to the microeconomics models I learned in class. Because the price of electricity can vary from zero to as high as 400 dollars per MWh within a single day, time series must contain each individual hour of the day and can easily escalate to enormous amounts of data, such as tens of millions of data points. As a result, it is easy to get large samples to run analysis on; however, implementation of data analytics techniques, such as the Monte Carlo simulation, becomes more challenging.

Knowledge and experience in energy were added to my skillset through sustainability focused programs available at Johnson. Context about carbon markets, which I acquired during the Environmental Finance and Impact Investing (EFII) program, was helpful in understanding one of the cost factors of some power plants. My project for the Sustainable Global Enterprise (SGE) Immersion Practicum exposed me to the concept of distributed energy. In addition, in the Strategies for Sustainability class we did a case study about the environmental impact of nuclear generation. Both were crucial in helping me understand the recent changes in the energy industry, such as the increasingly stronger relationship between electricity and NG prices, the disruption led by renewable generation in the energy sector, and the challenges in achieving emissions reductions.

My internship and classes at Johnson showed me that the power industry is a complex, interesting, and changing environment. Above all, I appreciate the fact that the industry lies in the intersection of economics, finance, data science, and engineering, and other sciences, meaning lots of opportunities to learn something new every day.

[1] ISO New England. (2016, July). About Us – What We Do. Retrieved from http://www.iso-ne.com/about/what-we-do

[2] OpenEI. (2016, July). Definition: Base Load. Retrieved from http://en.openei.org/wiki/Definition:Base_Load

[3] Shropshire, C. (2016, June 2) Exelon details plans to close Clinton and Quad Cities nuclear plants. Retrieved from http://www.chicagotribune.com/business/ct-exelon-closing-nuke-plants-0603-biz-2-20160602-story.html

[4] International Energy Agency (IEA). (2014). Technology Roadmap: Energy storage. Retrieved from https://www.iea.org/publications/freepublications/publication/TechnologyRoadmapEnergystorage.pdf

[5] New York Affordable Reliable Electricity Alliance (NY AREA). (2015, January 6). Power Pains: One Year Anniversary Of The Polar Vortex. Retrieved from http://area-alliance.org/index.php/resources/issue-briefs/power-pains-one-year-anniversary-of-the-polar-vortex/

[6] Welie, G. (2015, July 6). Letter to Commissioner Judith Judson, Department of Energy Resources, Massachusetts. Retrieved from http://www.iso-ne.com/static-assets/documents/2015/07/iso_response_doer_info_request_july2015.pdf

[7] Deliso, R. (2014, June 27). Regulated and Deregulated Energy Markets, Explained. Retrieved from http://www.energysmart.enernoc.com/regulated-and-deregulated-energy-markets-explained/