Unfolding Energy Efficiency in Eastern Partnership Countries

ISSUE NO. 16

by Oliver Kovacs, Ph.D.*

Fostering energy efficiency is a prerequisite of sustainable development. A recently published Synthesis Report examines the innovation ecosystem in member countries of the Eastern Partnership Countries of the European Union and its role in promoting energy efficiency. A more systemic understanding is to stimulate the necessary paradigm shift towards more qualitative growth that is required for EPCs to become sustainable emerging markets.

The seventeen Sustainable Development Goals (SDGs) adopted in the fall of 2015, as the successor of the United Nations’ Millennium Development Goals, demonstrate the widespread view that our planet and people need qualitative growth that enhances life. This concept characterizes economic, social and environmental systems as mutually interdependent; its premise is that the growth process should shift to a more qualitative growth whereby innovations in production processes and services would be made more efficient by internalizing environmental costs, involving renewable energies, zero emissions, the continual recycling of natural resources, and restoration of the Earth’s ecosystems.

A number of SDGs can be spurred by pursuing energy efficiency such as: 1) good health and well-being (goal 3); 2) increasing affordable and clean energy (goal 7); 3) developing sustainable cities and communities (goal 11); and 4) enhancing responsible consumption and production patterns (goal 12). Experience shows that sustainable economic dynamism involving both quantitative and qualitative growth is of essence because rising income levels are associated with an observable decline in energy intensity (IPCC, 2000; Metcalfe, 2008). Stimulating socio-economic dynamism is therefore key to coping with challenges like avoiding locking in energy inefficiency and securing the shift to a more qualitative growth.

This approach should be promoted in all countries, including members of the Eastern Partnership Countries (EPCs) of the EU such as Armenia, Azerbaijan, Belarus, Georgia, Moldova and Ukraine.

Research and Development for energy efficiency in EPCs – Institutional architecture matters

In a recent paper (2016), I analyzed the results of national studies on the major drivers, barriers and bottlenecks to energy efficiency in some EPCs. The studies were prepared within the European Union project INNOVER-EAST. In addition to identifying the major barriers and bottlenecks that are largely interrelated and are influencing the absorption, diffusion, demand and supply of Research and Development (R&D), the cited report also outlines policy recommendations with a list of potential innovation support services.

The report reveals inter alia that although Small and Medium Enterprises (SMEs) employ almost 50% of the labour force in most EPCs, they fall short in their contribution to the Gross Domestic Product (GDP) (about 30%) as compared to OECD countries where more than 55% of GDP is accounted for by SMEs. This points to the shortcomings of the innovation ecosystems in EPCs. What is more, due to the lower pace of development of the financial markets, the intermediation sector remains highly risk-averse. As a result, the room for SMEs to be engaged in risky R&D and innovations as well as adaptations of best practices for energy efficiency is still rather limited.

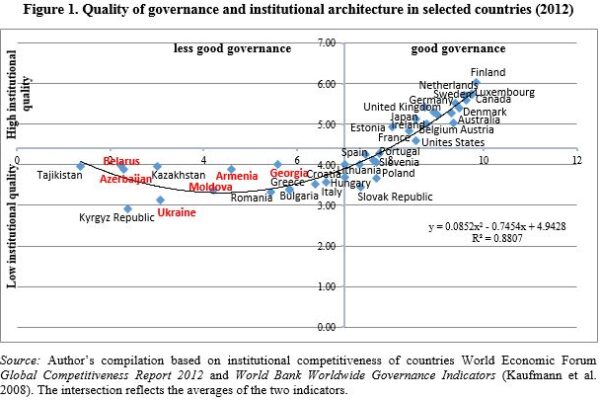

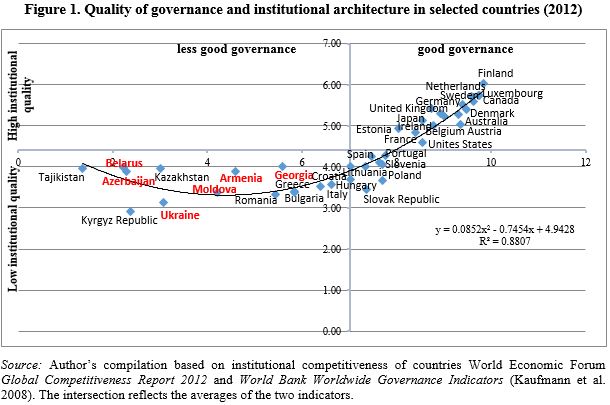

The report also shows that the quality of governance endogenously depends on the institutional framework in which innovation takes place (Figure 1). Figure 1 shows that EPCs are primarily found to have relatively less good governance and lower institutional quality below averages, which hampers R&D&I in general (especially in areas fostering new innovative technologies and services for energy efficiency).

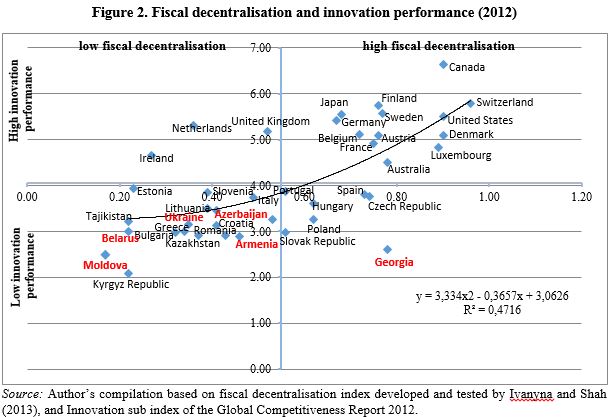

An important characteristic of the institutional architecture of a country is its degree of decentralization. The literature seems to suggest that a more decentralized system offers more innovation freedom, leading in turn to more competitiveness (European Commission, 2012), which means at least two things: (i) more initiative and self-empowerment; and (ii) closer relationships among stakeholders with increasing potential for cooperation for innovation. Figure 2 shows the relationship between the degree of fiscal decentralization and innovation performance in a broad sense. EPCs are again exhibiting low fiscal decentralization associated with low innovation performance.

SMEs, Innovation and Foreign Direct Investment

Experience in the developed and developing world shows that in turbulent times SMEs have typically much more resilience and stability in employment than large companies. The above mentioned underperformance (relative low contribution-capacity of SMEs to the GDP in EPCs) results partially from the challenges they face in accessing the resources indispensable to innovation, and in the poor diffusion of new or significantly improved products, services, processes and business models.

Let us stress that SME development and innovation activity work in tandem. Innovation activity can easily come to a standstill or can be readily deterred if the business environment for SMEs is not conducive to it (e.g. corruption, weak rule of law). SMEs’ development and thus innovation activity often require knowledge transfer, mainly from more developed transnational companies and foreign investors. Since technologically more advanced companies tend to be less engaged in joint ventures (see Smarzynska – Shang-Jin, 2000; Al-Sadig, 2009), when it comes to foreign direct investment, the learning process and knowledge transfer suffer. Consequently, SMEs’ development cannot be as dynamic as it would be in a more advanced position. Foreign Direct Investment in countries where corruption and the lack of transparency are predominant is found to have a positive impact on the development of the institutional environment of the host countries in the long term (Kwok – Tadesse, 2006). But in EPCs, this impact is hampered by various factors such as low institutional quality and poor governance, which tend to lead to inefficient innovation inputs in terms of skilled workers, risk-taking mind-set, capacity to increase R&D expenditures by resulting in insufficient investment flows into riskier fields like fostering energy efficiency etc. (Fischer et al., 2017). For example, in Ukraine, often considered an emerging market, there is an insufficient level of investment that could interact with local technology development and R&D.

Hence, policymakers should revise incentive regimes for FDI (grants, tax incentives etc.) and seek out ways to link FDI incentives to innovation and smart adoption that foster energy efficiency. FDI should be tailored towards knowledge transfer relating to energy efficiency.

Looking forward

The report shows that there is less room for decentralized initiatives in EPCs. It means that the “freedom” of every business actor such as SMEs to determine where they want to invest is relatively low in EPCs. This fact per se provides weaker incentives for being innovative in legal and efficiency improving terms. The INNOVER National Studies also illustrate that a poor legal framework, dysfunctional institutions, lack of professionalism, and corruption are prevalent features of some of the analyzed EPCs’ political-social and economic systems. In such circumstances, competition suffers. In addition, the low level of financial intermediation combined with the more centralized state structure (often leading to less efficient resource allocation) are more likely to lead to a financing system for innovation that is inadequate and lacks flexibility. The EPCs’ innovation ecosystem does not offer enough space for extensive experimentation, especially in fields like energy efficiency. Room for decentralized initiatives, appropriate incentives, competition and flexible financing would be the main prerequisites of an impulsive innovation ecosystem.

In conclusion, expecting a smooth process of EPCs (especially Armenia, Georgia, Moldova or Ukraine) towards becoming sustainable emerging markets would be more than a Panglossian optimism. Catalytic and transformative policy mix are indispensable for these countries to meet sustainable development goals and to become real emerging markets. The contours of such policy mix can be drawn around short term as well as medium and long term strategic recommendations.

The short-term recommendations would include:

(i) acknowledging the crucial role of teaching, training, advisory activity in stimulating innovation oriented culture and mind-set;

(ii) spurring trust by enhancing public-private-third consultation mechanism;

(iii) fostering collaboration between research and industry;

(iv) cultivating feedback loops by facilitating the clustering of firms;

(v) seeking options to overcome the major shortcomings in banking systems and other financial institutions;

(vi) revising the FDI incentive regime;

and (vii) unfolding the transformative power of public procurement.

With respect to medium and long term strategic recommendations, the list must include: (i) acknowledging that policy requires constant adaptation; (ii) reinforcing the innovation ecosystem by focusing on the relationships among its various components; (iii) pursuing holistic innovation policy; (iv) attracting and mobilizing additional financial resources for transformative investments; and (xi) heightening the role of governance (for business and society as a whole) in the development of sustainable and effective collaborations.

References

Al-Sadig, A (2009), “The Effects of Corruption on FDI Inflows.” Cato Journal, Vol. 29., No. 2.

European Commission (2012), “Policies Supporting Innovation in Public Service Provision”, INNO-Grips Policy Brief, European Commission, DG Enterprise and Industry.

Fischer, B and Tello-Gamarra, J (2017), “Institutional Quality as a Driver of Efficiency in Laggard Innovation Systems”, Revista de Globalización, Competitividad & Gobernabilidad, Vol. 11., No. 1, pp. 129-144.

IPCC (2000), “Special Report on Emissions Scenarios”, Cambridge University Press, Edinburgh Building Shaftesbury Road, Cambridge.

Ivanyna, M and A Shah (2013), “How Close Is Your Government to Its People? Worldwide Indicators on Localization and Decentralization”, World Bank, Policy Research Working Paper No. 6138.

Kaufmann, D and A Kraay and M Mastruzzi (2008), “The Worldwide Governance Indicators: Methodology and Analytical Issues”, World Bank, Policy Research Working Paper No. 5430.

Kovács, O (2016), “Energy Efficiency in Eastern Partnership Countries – Unfolding Research & Development and Innovation in Promoting Energy Efficiency”, INNOVER-EAST Synthesis Report.

Kwok, C. – Tadesse, S. (2006): The MNC as an Agent of Change for Host-Country Institutions: FDI and Corruption. William Davidson Institute Working Paper No. 882.

Metcalfe, G E (2008), “An Empirical Analysis of Energy Intensity and Its Determinants at the State Level”, The Quarterly Journal of the IAEE’s Energy Economics Education Foundation, Vol. 29. No. 3.

Smarzynska, B. K. – Shang-Jin, W. (2000): Corruption and Composition of Foreign Direct Investment: Firm-Level Evidence. NBER Working Paper No. 7969.

*Olivér Kovács, Ph.D

Research fellow, ICEG European Center

Member of the Economics and Law Section of the Hungarian Academy of Sciences,

Committee on World Economics and Development Studies

The opinions, beliefs and viewpoints expressed by the various authors in this article do not necessarily reflect the opinions, beliefs and viewpoints of Cornell University and the Emerging Markets Institute, or official policies of the Cornell University and the Emerging Markets Institute

Copyright Statement and Policy: the articles from this series and on the Emerging Markets Institute web site may be freely redistributed in other media and non-commercial publications as long as the following conditions are met. 1) The redistributed article may not be abridged, edited or altered in any way without the express consent of the author and 2) The redistributed article may not be sold for a profit or included in another media or publication that is sold for a profit without the express consent of the author.