The Future of Clean Energy: Achieving Resilience

With traditional energy prices falling, the renewables sector struggles to remain competitive while maintaining a focus on long-term growth.

Kevin Johnson, MBA ’09, watched the Iraqi oil fields burn while on deployment to the region in 2004–05. The experience left an indelible impression on the former U.S. Army Captain.

“My service in the military is the key reason why I got into renewable energy in the first place,” says Johnson, managing director, of federal and microgrid business development at Canadian Solar. “The military has led our energy transformation many times; for our national security, for resiliency, and to reduce the cost of our force.”

U.S. energy independence, establishing resilience in the power grid, and the prospect of global instability caused by climate change are some of the leading factors driving growth in the renewable energy industry. But with oil and natural gas prices declining steeply over the past few years, investment in the sector has taken a hit.

Leaders in the renewable energy field, including several Johnson alumni, are confronting multiple challenges: low fossil fuel prices, reduced investment, and the impending expiration of government tax incentives. At the same time, they are keeping an eye on the future and on clean energy’s role in shaping the world’s energy mix.

Growth in Wind and Solar Faces Headwinds from Traditional Energy

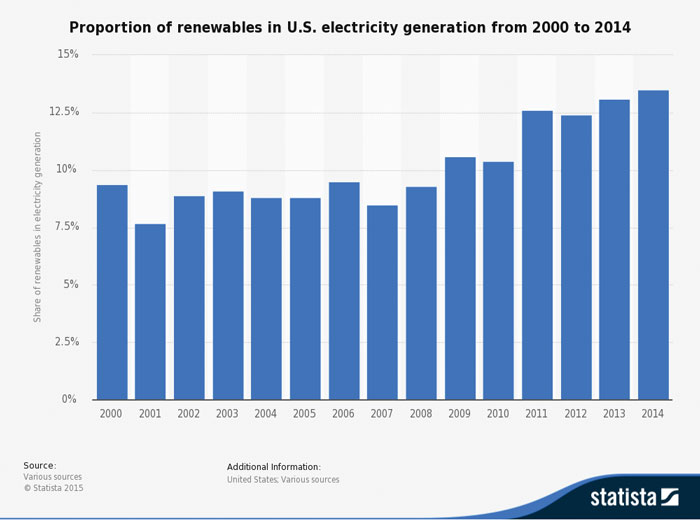

Although renewables have made impressive strides in both efficiency and capacity in recent years (Fig. 1), investment is lagging due to competition from low-priced fossil fuels.

Through the first half of 2015, solar has accounted for 40 percent of all new electricity generation capacity brought on line in the United States. Solar energy powers 785,000 homes and small businesses in the country, and a new solar project is installed every two and a half minutes.1

The story is similar for wind, with a total of $8.3 billion in new investments made in 2014. Wind now provides almost 5 percent of total electricity in the U.S.2

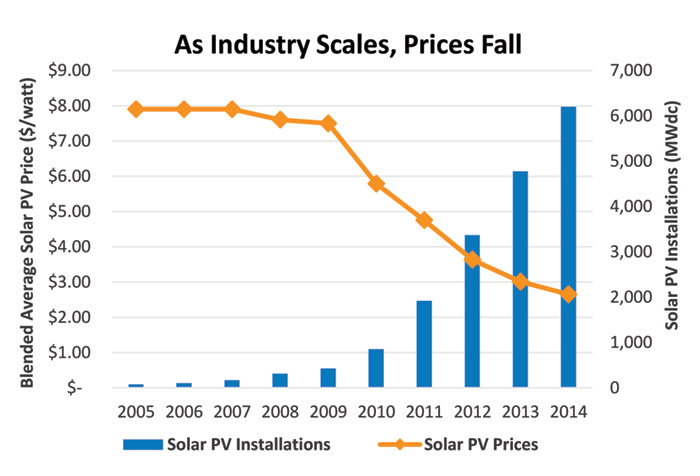

Efficiency metrics have also improved in both wind and solar, with average prices falling by two-thirds for wind and nearly 50 percent for solar over the past five years (Fig 2). According to the U.S. Energy Information Administration3, by 2020 the levelized cost of electricity from wind will be on par with conventional natural gas-fired power plants, and solar photovoltaic technology will be approaching parity as well. (Levelized cost is determined by the cost to install a renewable energy system divided by its expected lifetime energy output.)

Despite these impressive cost reductions, low conventional energy prices have impacted the market for renewables. This would seem to defy reason, since oil does not compete directly with renewable energy sources in terms of electricity generation, according to the U.S. Energy Information Administration. Oil is used primarily as fuel in the transportation sector and as feedstock in manufacturing materials such as plastics. In fact, less than 1 percent of electricity is generated by oil-fired power plants in the United States. Nevertheless, the recent dramatic drop in global petroleum prices has had a dampening effect on investment in solar and wind.

“Since wind and solar don’t really compete with oil, there shouldn’t be much of a correlation between oil prices and the performance of shares of renewable energy companies,” says Frank Nicklaus, ’04, MBA ’12, a vice president with Greentech Capital Advisors, “But nonetheless, declining oil prices have certainly contributed to a big sell-off in renewable energy stocks during the last three to six months.”

Nowhere has this trend been more evident than in the declining values of “yieldco” stocks. Yieldcos are publicly listed companies that acquire and operate businesses such as renewable energy assets. They generally have stable underlying cash flows, the majority of which are paid out as dividends to shareholders.

Recently, the market values of yieldcos have fallen in close correlation with those of master limited partnerships (MLPs), a similar type of investment vehicle typically comprised of oil and gas commodity assets. Industry analysts have blamed the drop in yieldco values on the market’s irrational correlation of renewables with low conventional energy prices, combined with the likelihood of interest rates rising in the future, which would increase the cost of capital and therefore reduce the value of yieldco projects.

“Unlike with oil, there is a very meaningful connection between natural gas prices and the competitiveness of wind and solar,” Nicklaus says. “About 30 percent of our electricity in the United States is generated from gas-fired power plants, which typically set the market clearing price for power. It is a lot easier for renewables to compete if you’re in a high gas price environment and you’ve got $75 per megawatt-hour power, instead of say $30 per megawatt-hour power like we’re seeing with such low gas prices today.”

“Natural gas really did upset the economics of renewables over the last several years,” says Mark B. Milstein, clinical professor of management and director of Johnson’s Center for Sustainable Global Enterprise. “It’s not going anywhere. It’s a cheap fuel, there’s a lot of it, it’s certainly better than coal, and it’s a cleaner burning energy than oil. But it’s still got its environmental challenges.

“If we’re going to deal with climate change in a serious way, the fact of the matter is that there are energy assets that we know exist that we have to leave in the ground,” Milstein adds. “Natural gas is going to fall into that category eventually.”

Shifting Government Subsidies

Another big challenge facing clean energy firms is the deepening shadow of expiring federal and state grants and tax incentives. Much has been made on both sides of the political fence about the government’s use of subsidies and other incentives to help drive investment and deployment in the renewable energy sector, but they have made an impact.

“The problem with the government subsidies and policies is: ‘When are they expiring?’” — Professor Glen Dowell

“On average, government subsidies have strongly helped the sector,” says Glen W.S. Dowell, associate professor of management and organizations at Johnson. “But what any business relies on is having a nice, predictable institutional environment, and so the problem with the government subsidies and policies is: ‘When are they expiring?’ And it’s not clear that they’re going to be renewed. The more uncertainty there is in the length and scale of these government programs, the more it forestalls investment.”

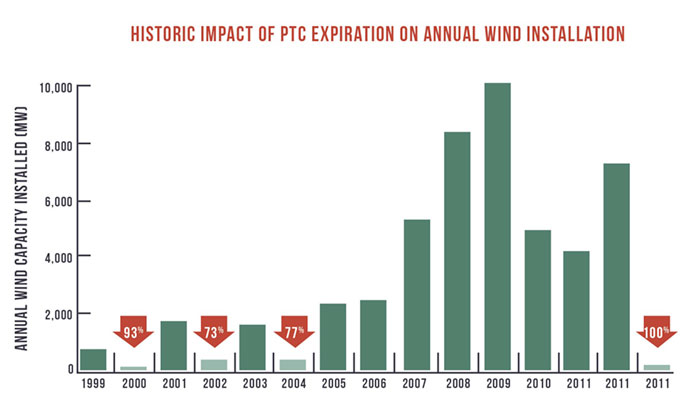

Since 1999, there has been a strong correlation between the presence of government subsidy programs for wind and installation activity. Each time the government’s wind production tax credit (PTC) program expired in 2000, 2002, and 2004, new installations declined markedly (by 93 percent, 73 percent, and 77 percent, respectively) (Fig. 3). Based on this history, there is trepidation that the scheduled expiration of the federal solar tax incentives at the end of 2016 will precipitate a significant downturn in new installations. Industry leaders are doing their best to plan for this eventuality by taking a conservative approach toward expansion and hiring.

“Current tax incentives certainly have helped get this industry moving forward,” says Alex Hagen, MBA ’03, vice president of finance at Renovus Energy, an installer of residential and commercial solar-electric photovoltaic systems in the Finger Lakes region of New York State. “But as the cost to install solar has dropped, these incentives have been gradually reduced. Uncertainty is the part that’s most grating on us. It’s not knowing whether we can expand from 70 employees right now up to 200 by the end of 2016.”

According to Robert Petrina ’00, MBA ’08, four conditions are necessary for solar and similar renewable energy sources to become viable. “You need to have relatively high traditional power prices,” says Petrina, managing director and president of JA Solar USA, a leading manufacturer of high-performance solar power products based in Shanghai, China. “You need to have good solar or other resources. You need to have the policies in place that enable the deployment of solar. And you need access to reasonably priced capital. You may be able to trade off between higher power prices and lower solar resources, but you can’t do without policy support and access to capital.”

Petrina points to Europe’s up-and-down investment in renewables over the past decade as evidence of what can happen without adequate balance among these critical factors. “You can go as far back as Spain in 2008, which had essentially over-incentivized the solar sector, and you had a huge boom in installations followed by an immediate crash and subsequent retroactive cuts to already contracted incentives. It was clear that it was not a sustainable level of investment.”

Cornell and Johnson Lead the Way

Johnson is demonstrating a commitment to help solve these challenges facing the renewable energy sector by both attracting and developing leaders in the field. Johnson’s Center for Sustainable Global Enterprise is successfully attracting MBA candidates interested in renewable energy, and counts many alumni who are propelling the industry forward.

“The big driver of why I went to Cornell and the Johnson School was the immersion program in sustainable global enterprise,” says Johnson of Canadian Solar. “The school has graduated many leaders in the renewable energy space. I would say that in almost any major institution in renewable energy, there is a Johnson-Cornell graduate.”

Sustainability and the “triple bottom line” are ideals drawing leaders into the clean energy sector. “Triple bottom line” refers to redefining corporate impact and measures of success evenly across financial, sustainability, and social parameters; it is an accounting term originally coined by John Elkington in 1994 and sometimes referred to as “People, Planet, Profit.” The concept resonates within the clean energy sector, with its focus on environmental sustainability.

“The business school was a very early pioneer and trailblazer in educating the next group of executives in sustainability and in giving people the tools to understand that there was more to assessing a business than just its financial performance,” Petrina says, referring to Johnson. “Cornell has a very strong network with established leaders in this quickly growing space, especially when you look at the size of the school relative to others.”

The Cornell Energy Club helps to grow that network by connecting Johnson students with interest in the energy industry across both renewable and traditional sectors. The club hosted its seventh annual Johnson Energy Connection conference this past October, bringing graduates working in the industry back to campus to meet and network with current students. Nicklaus is one of those leaders.

“It’s very unique in that you have a sustainability-focused center nested within an MBA program,” Nicklaus says, noting that Johnson is strategically differentiated to attract students with an interest in renewables.

Milstein says that part of the core mission of the Center for Sustainable Global Enterprise is to work with the private sector to help commercialize new technologies and support financial investment in the clean energy sector.

“Just this year alone, we’ve worked with solar companies to look at development of microgrid businesses internationally,” Milstein says. “We’ve looked at the development of the energy storage market, which is critical to the long-term development and expansion of solar and wind, and we’ve worked with very large utilities facing an upheaval in the regulatory market.

“When it comes to business and sustainability, that’s a sweet spot for us,” Milstein adds.

Cornell has also made clean energy a focus on campus, implementing new technology to reduce both the university’s carbon footprint and energy expenses. To this end, Cornell’s most recent climate action plan has set a goal of net carbon neutrality by 2035. One major project was the Combined Heat and Power Plant, built in 2009 and now supplying the majority of Cornell’s total heat and power needs with reduced emissions.

Last December, Cornell signed an agreement with the Black Oak Wind Farm in Enfield, N.Y., to purchase all of the wind farm’s energy for at least ten years. The purchase is projected to provide about 20 percent of Cornell’s annual electricity use, and it will reduce the university’s greenhouse gas emissions by about 5 percent.4

Taking the Long View

There are reasons to believe that the renewable energy sector will continue to attract strong investment, despite the recent downward pricing pressure from conventional energy sources.

“Energy is a highly cyclical industry,” Milstein says. “Oil prices are extremely low right now, but they are more than likely to go up again in the future. It almost seems that the link between the investment in renewables and the price of oil and gas is not what it once was, because you’ve got climate change that’s putting pressure on the need for renewables in the energy mix. So there is a separate driver altogether regardless of what the price of oil is, which is the need for carbon-free energy production.”

While there is some debate as to what renewable energy source has the best chance of dominating the industry in the long term, experts agree that renewables will have to be part of the overall energy mix.

“If we think about the bigger issues and what renewables are trying to solve — which is climate change and energy security — then we need a portfolio approach,” Dowell says. “We’re not going to be able to mitigate everything. We have to think about adaptation; we have to think about cleaner energy; we have to think about conservation.”

1 2015 Solar Energy Industries Association.

2 U.S. Office of Energy Efficiency & Renewable Energy, 2014 Wind Technologies Market Report, August 10, 2015.

3 U.S. Energy Information Administration, Annual Energy Outlook 2015, April 14, 2015.

4 Casler, Andrew. “Black Oak Commits to $99K in Tax Payments.” Ithaca Journal, Feb. 25, 2015

Comments