Taper Tantrum Versus the Current Reflationary Scare

By Gautam Jain, Emerging Markets Institute research fellow

US yields spike higher

History doesn’t repeat itself, but it often rhymes. Whether Mark Twain said this or not, the quote is quite apt for US Treasury markets. For those not following closely, the US 10-year yield — often considered a bellwether for the global rates market — has risen sharply since the start of the year. It has increased from 0.9% to above 1.5% currently.

When it became clear last spring that the potential economic impact of the pandemic could be severe, the US Federal Reserve and Congress provided record monetary and fiscal stimulus. The US 10-year yield bottomed at 0.5% at the peak of the crisis. It then turned around when it appeared that the worst may be behind, and the stimuli would help the economy recover.

The rise in yields gathered pace after the Democratic Party took control of the Senate from the Republican Party at the start of 2021 on the heels of Joe Biden’s victory in last November’s presidential election. The changes at the helm of the US government ensured that further fiscal support would be forthcoming. Indeed, 2021 growth forecasts for the US were upgraded considerably, with the IMF revising its forecast from 3.1% in October to 5.1% in January.

Reflationary expectations thus started building in the US Treasury market, resulting in a spike in long-end yields. Reverberations of the sharp rise in US yields were felt in the global rates market and eventually spilled over to risky assets, including those in emerging markets (EM).

How have EM currencies reacted?

EM currencies have been relatively resilient throughout the correction in US Treasuries. To demonstrate this point, we compare the performance of EM currencies during the so-called Taper Tantrum of 2013 with the current sell-off.

We chose Taper Tantrum as the episode to compare because of its similarities with the current reflationary scare. To recap, in the spring of 2013, financial markets went into a reflationary panic when the Fed announced that it might start tapering its QE-related bond purchases. Starting in May 2013, the US 10-year yield increased from 1.7% to 2.7% in just over two months.

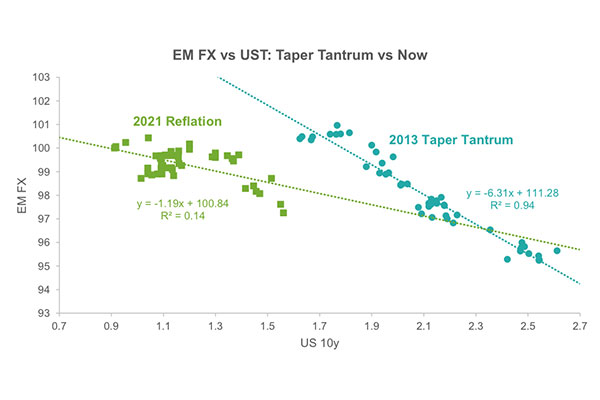

In the chart below, we regress EM currencies against US yields, both in the current episode as well as during the Taper Tantrum of 2013. We normalized our EM currency index, which comprises 22 equally weighted liquid emerging market currencies, to 100 just before each episode to make it easier to compare.

As the chart shows, while EM currencies corrected by around 6% during the Taper Tantrum, this time around, the correction is just around 2%. The difference between the two episodes can also be ascertained from the ratio of the slopes of the two regression lines. Just as importantly, the regression fit is quite poor this time around compared to the strong fit during the Taper Tantrum. The weaker fit implies that the weakness in EM currencies since the start of the year may not be related to US yields alone. Rather, other factors, including idiosyncratic ones, could also be at play.

There are a few reasons for the differences in the performance of EM currencies in the two episodes:

- Valuations – EM currencies have underperformed other risky assets during the current recovery and are cheap in real effective exchange rate (REER) terms. At the time of the Taper Tantrum, EM currencies were expensive in REER terms (see BIS data).

- Flows – EM local markets had received massive inflows before the Taper Tantrum, which is not the case this time around.

- External balances – At the time of the Taper Tantrum, several large emerging countries were running large current account deficits. They were thus vulnerable to retrenchment of global liquidity, the risk of which increased with higher global yields. External balances are in better shape in most emerging countries this time around.

- High risk premium built for vulnerable countries – Of all the emerging countries, the two that have weak macro stories are Brazil and Turkey. However, currencies in both countries had lagged significantly even before the correction in US Treasuries. As such, some of the risks were already priced in for the vulnerable countries.

While it is positive that, so far, EM currencies have not been hurt as severely as in previous similar episodes, it is too early to declare victory. Compared with the Taper Tantrum, the US 10-year yield has adjusted by only half as much in the current episode. If the sell-off in US Treasuries continues, then more vulnerabilities may come to the fore, besides the known ones.

Overall, though, history so far hasn’t repeated itself in the case of EM currencies.

How have EM rates reacted?

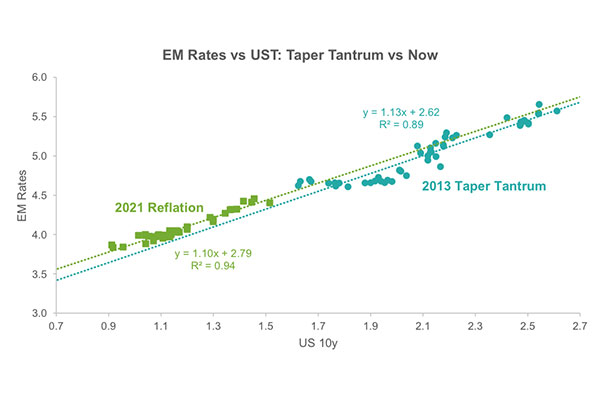

To place the sell-off in EM rates in context, similar to EM currencies, we compare it with the correction during the Taper Tantrum of 2013.

Once again, we regress EM 10-year rates (average of 19 liquid EM rates) against US 10-year yield, both in the current episode and during the Taper Tantrum of 2013. As the chart shows, the slopes of the two regression lines are very similar. Moreover, the regression fits for both episodes are strong. We can thus expect the average EM 10-year rate to adjust higher with a similar beta if the US 10-year yield continues to sell off.

History, in this case, appears to have rhymed nicely.

About Gautam Jain

Gautam Jain is a research fellow in the Emerging Markets Institute at the Samuel Curtis Johnson Graduate School of Business. He has over 20 years of experience covering global emerging fixed income markets, both as a strategist and a portfolio manager. He has worked in buy-side and sell-side firms, including the Rohatyn Group (TRG Management), Barclays Capital, and Millennium Partners. He has helped manage emerging markets local-currency and hard-currency debt funds. The assets that he covers include currencies, interest rates, sovereign credits, and related derivatives. He specializes in portfolio construction, smart-beta index creation, and asset allocation. Gautam holds a PhD in operations research from Columbia University and is a CFA charter holder.

Comments