Resilience Distinguishes Emerging Market Economies

While China continues to solidify its lead, other emerging markets show steady economic growth in the Emerging Market Multinationals Report 2017 and in discussions at the 7th Annual Emerging Markets Institute Conference: “Emerging Multinationals in a Changing World.”

The strength of emerging markets has changed the face of international trade and investment, with the power of Asian companies leading the global transformation. These emerging markets have developed global brands too, pitting them against U.S. and European competitors.

“These companies are moving from local to becoming formidable competitors,” said Lourdes Casanova, senior lecturer and academic director of the Emerging Markets Institute at the Cornell SC Johnson College of Business. “They are efficient and continue to compete on price. They are really making inroads. And there’s a change at the top of the guard.”

A key organizer of Cornell’s seventh annual Emerging Markets Institute (EMI) conference, “Emerging Multinationals in a Changing World,” Casanova also co-authored the Emerging Market Multinationals Report 2017, released at the conference. About 150 students, academics, international business leaders, government officials, and Cornell alumni attended the Nov. 10 event, held at the recently opened Cornell Tech campus on Roosevelt Island in New York City.

The release of the Emerging Market Multinationals Report 2017, co-authored by Casanova and Anne Miroux, a faculty fellow at the Emerging Markets Institute, and the discussion surrounding the statistics and analyses included in it, was the highlight of the conference. In addition, the conference included panel discussions focused on the role of multinationals in emerging markets; business opportunities in Brazil and Argentina; financial markets in Mexico; and the challenges faced by China and India in the global marketplace. The conference also launched EMI’s inaugural Emerging Markets Case Competition, at which students representing three business schools competed, with the Cornell SC Johnson College of Business team finishing second.

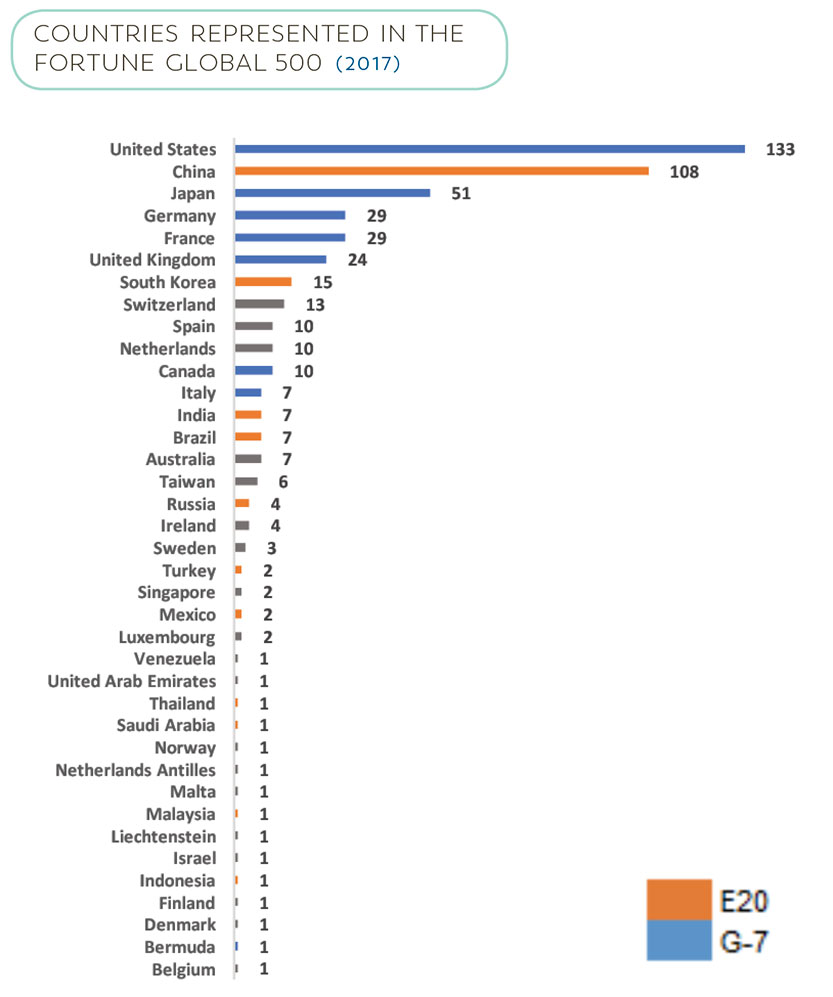

In an effort to define emerging market countries, report authors Casanova and Miroux selected the top 20 emerging economies based on the size of their gross domestic product (GDP), population, and significant influence in global and regional trade and investment. These 20 national economies, called the E20, produce 46 percent of the world’s GDP, up from 30 percent in 2000, and have 54 percent of the world’s population.

These 20 national economies, called the E20, produce 46 percent of the world’s GDP, up from 30 percent in 2000, and have 54 percent of the world’s population.

Josep Maria Coll Morell, associate professor and director of the EU-Asia Global Business Research Center at EADA Business School in Barcelona, who moderated the panel, “Multinationals in Emerging Markets,” was blunt in his analysis of how companies from these nations have prospered: “The emerging markets are growing and conquering the world,” he said.

China’s growth trajectory gains momentum

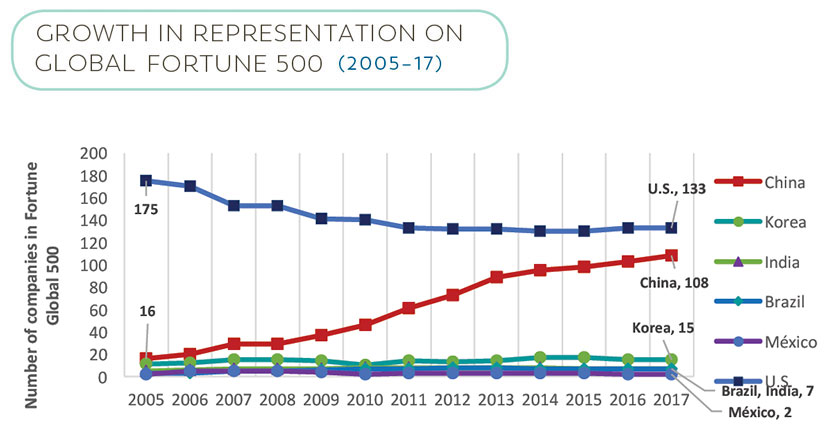

The report provided startling details about the rapid growth of China’s economic power in the global marketplace by analyzing the home country of corporations listed in the 2017 Fortune Global 500. In 2005, the United States listed 175 companies among the top 500, compared to 16 for China. Twelve years later, the number of Chinese companies has skyrocketed to 108, while the U.S. total has slumped to 133. Other emerging markets — South Korea, Brazil, India, and Mexico — account for 24 of the top 500 companies in 2017.

The expansion has been rapid; China opened its economy to the world economy in 2000. “It’s an amazing growth of the Chinese companies,” said Miroux.

The report found that, among the E20, China, India, the Philippines, and Iran showed the strongest GDP growth in 2016. In the same year, Brazil, Argentina, Russia, and Nigeria showed the biggest downturns in GDP.

The global rise of Chinese corporations extends to eight high-profile industry groups: banking, logistics, automotive, telecommunications, engineering and construction, petroleum refining, metals, mining, and crude oil production, the report found. In 2004, none of the emerging markets had companies that were among the top five in these industries. In 2017, Chinese companies are the industry leaders in banking, engineering and construction, petroleum refining, and metals. China holds half of the top five companies in those eight sectors.

These nations are developing global brands that compete with those in the developed world. Casanova said that WeChat, the Chinese social media platform for instant messaging and e-commerce, has an online payment system that’s better than the one developed by Apple. “Those that were dismissed as local innovators are now much more competitive,” said Casanova.

China has led the way in foreign direct investment, with its state-owned companies expanding across the globe. Much of the expansion has come via mergers and acquisitions, as well as investments in Africa and Latin America. The strong role played by the national governments of China and South Korea has been crucial to the rise and strength of their economies.

The support for Chinese multinationals came through the government’s “Go Global” strategy, begun in the early 2000s, which relaxed foreign investment controls and streamlined the approvals process. In South Korea, government policies since the 1990s have encouraged foreign investment, with prior notification and approval from a foreign exchange bank now the only requirements, the report found.

“The government role is so crucial in Asia,” said Miroux.

Multinationals in Emerging Markets: Opportunities and Risks

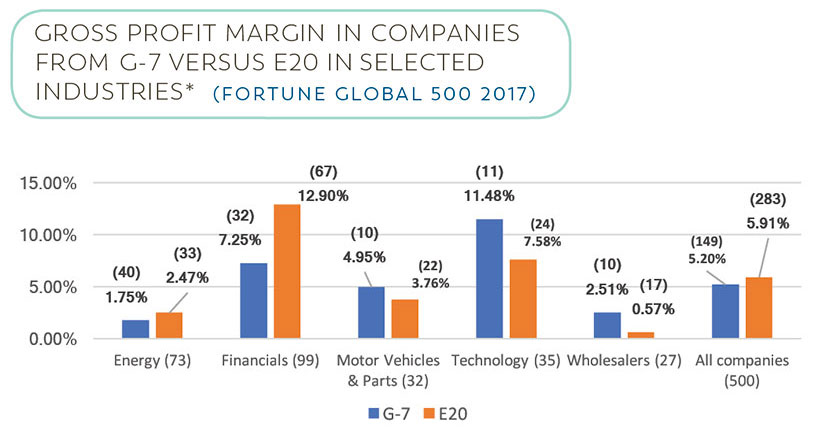

Multinational corporations in emerging markets got a foothold on the world stage mainly by competing on price, but that is changing. While some of them continue to compete on price, others have developed global brands that compete with multinationals headquartered in the G7 nations, according to the Emerging Market Multinationals Report. China’s Lenovo laptops, Korea’s Samsung mobile phones, and Brazil’s Havaianas clothing lines have emerged as global brands that compete all over the world. “These emerging multinational corporations are transforming their products from cheap knock-offs to brand names in their own right,” the report said.

The rise of the emerging markets has also brought about the development of multilateral financial institutions to rival the World Bank, including the Asian Infrastructure Investment Bank in China and the New Development Bank, developed by Brazil, Russia, India, China, and South Africa. Their focus on infrastructure financing targets a sector that is vital for growth and development where the needs for capital are enormous, the report found.

Business opportunities abound in the developing world: 80 percent of the growth in global consumer demand will be in low- and middle-income nations, said Christopher Barrett, deputy dean and dean of academic affairs at the Cornell SC Johnson School of Business. Moreover, urbanization continues to accelerate in emerging markets, and as Barrett noted in his opening remarks at the conference, “Urbanization creates an enormous opportunity for those who are prepared.”

Succeeding in the emerging markets can be risky, however. It requires foresight, solid partnerships on the ground, and the ability to change strategies quickly, speakers on the “Multinationals in Emerging Markets” panel said.

“You have to be flexible, creative, and adaptable,” said Roberto Cañizares ’71, MBA ’74, former president of MSA International, a safety products company, and a member of the advisory board at the SC Johnson Graduate School of Management. “It’s a rollercoaster ride that can go sideways.”

In less developed markets, ventures can turn sour if company executives are arrogant and impatient. “You need to be curious and humble,” Cañizares said. “And despite what you do, it may not work. The most successful multinationals want to learn and don’t expect results right away.”

Kevin McGovern ’70, chairman and chief executive officer of McGovern Capital, whose company has funded dozens of startups, warned that working in the emerging markets takes a keen eye and the ability to change direction if your plan goes awry in the local marketplace. “If you can’t handle bad news, don’t be an entrepreneur,” he said. “You have to think from a Darwinian point of view. It’s not the most intelligent species that survives. It’s the one that adjusts to change. You have to prepare to sharpen your saw.”

McGovern warned of roadblocks to success. Basics, such as reliable electricity and an adequate road system, can be essential for a new venture. So are skilled workers, which some governments will train. Company executives need to understand the financial system, with its capability to accept mobile payments and take action on credit card fraud. An entrepreneur needs to understand a nation’s intellectual property laws and how a contract gets enforced.

Then there’s the issue of government officials with a handout to hasten approvals. Don’t fall for it, McGovern warned. “You will be asked by government officials, ‘What’s in it for me?’” McGovern said. “You give a bribe, and that official has a gun to your head for the rest of your life.”

Also beware of strategies that could diminish your standing, McGovern warned. “When you are in an emerging market, you are in a glass house,” he said. “When they take you out to dinner, they will try to figure out your weakness. Keep your morals intact. And show them, step by step, why you are important to them.”

Rustom Desai, MBA ’95, director of commercial operations for Corning’s Precision Glass Solutions, said that it’s crucial for company executives to understand the overarching objective of the country where they’ve located their business. “There could be a national movement to be something, and that national movement will influence how its government interacts with you,” said Desai. “Right now, China wants to be ‘number one’ with growth and market share.”

Good partners on the ground are essential, especially if you are operating in a country where you don’t speak the language, said Dolev Rafaeli, MBA ’18, who serves on the board of directors of FC Global Realty. “You need someone to help translate for you what is going on,” he said. “Picking the wrong person can cause devastating damage. When you get the wrong partner, you can get the wrong translation of what’s going on, and that could lead to legal consequences.”

Mexico’s new stock exchange

The emergence of Mexico’s second stock exchange in 2018 will spark competition with the existing Mexican Stock Exchange, said Timothy Heyman, president of Franklin Templeton Asset Management, in a panel on “Business Challenges in Latin America.”

The new stock exchange, called BIVA, would provide a boost for Mexico, Latin America’s second largest economy and a country that has the world’s 15th largest GDP, said Heyman, editor of the Emerging Markets Institute’s monthly Templeton EMI Report. It will run on the technology used in the NASDAQ exchange on Wall Street, which could lower operating costs, Heyman said. Major investors in Mexico include the national pension fund, which has investments estimated at about $150 billion.

The second exchange could also spur more Mexican companies to go public, although obstacles to creating more public companies remain, Heyman said. For one, Mexico is dominated by family-owned businesses, which pass on leadership and company assets from generation to generation. The disclosure requirements of public offerings is another concern in a country where kidnapping has been a threat to corporate leaders. The average-sized company currently listed on the Mexican stock exchange has a value of about $2.7 billion. “In an insecure country, you don’t want to say how rich you are,” said Heyman.

Mexico’s second stock market comes as its economy continues to mature: The Mexican middle class has grown substantially over the past 40 years, and poverty has declined from 60 percent to 40 percent of the nation’s population, Heyman said. Private education has grown over the same time period. “Overall, inequality has decreased,” Heyman said. “But in a period of rapid technological change, there are some who are very rich, and they are getting richer.”

The impact of politics in Brazil and Argentina

Brazil, Latin America’s largest economy and the eighth largest in the world, was one of the world’s fastest growing economies in the early 2000s. But political turmoil in Brazil has taken its toll, according to the Emerging Markets International Report. The nation’s former president, Dilma Rousseff, was impeached in 2016, and its current president, Michel Temer, is under corruption investigation.

Investment activity in Brazil dropped 10 percent in 2016, and its recession dragged into 2017. In response, the Brazilian government has moved to attract corporate investment by privatizing government-owned enterprises. The program will shrink the national government and rely on the private sector to run key elements of Brazil’s infrastructure. The program was launched in 2016 by the government of President Temer, which has solicited bids to sell off several state-owned airports, port terminal facilities, roads, and a government-run power company. Petrobras, the state-owned oil and gas company, which ranked 75th in the Fortune Global 500, has already sold assets to private companies in Argentina, Japan, and Chile over the past three years.

The plan also includes a cap on government spending, as well as a balance of fiscal and monetary policy, which has lowered inflation to 3 percent and brought down interest rates.

Roberto Ardenghy, the Brazilian Consulate’s deputy consul general, and Geraldo Moura, advisor to the Presidency Grupo Plantar S/A, touted the privatization program in a panel on “Business and Opportunities in Brazil and Argentina.”

“These [infrastructure projects] must be in private hands,” said Moura.

The push for privatization coincides with Brazil’s crackdown on corruption, known as Operation Car Wash, which Ardenghy said led to the convictions of 112 Brazilians in a wide-ranging investigation that ensnared high-ranking government officials, several state-owned companies, and some of Brazil’s largest construction companies. “The Car Wash scandal has cleaned house,” said Ardenghy. “We are fighting corruption. The investigation has created a higher ethical standard, and we have created a more level playing field.”

Before the investigation, the Brazilian construction industry was dominated by a few large companies. Since the convictions, small and midsized companies have become more competitive. Foreign construction companies have found a foothold too, he said.

Nevertheless, Brazil still faces major challenges, said Moura. Taxes are high, the nation’s infrastructure is underdeveloped, and the government bureaucracy can prove frustrating to entrepreneurs looking to open a business.

But Brazil remains optimistic, promoting itself as a nation with abundant natural resources including offshore oil, a dynamic private sector, a vigorous democracy, and good relations in the international arena. Its agricultural sector is doing well too: Brazil is a major producer of beef, chicken, soybeans, coffee, and sugar cane.

The Brazilian people’s ability to adapt to changing conditions also provides promise for the future, Moura said. “What makes Brazil competitive is our arable land, fresh water, minerals, and the people,” he said. “We have things to teach about adaptation, flexibility, and creativity in the business environment.”

In Argentina, meanwhile, the election of Mauricio Macri as president in 2015 also marked a shift in the nation’s economic policies: The new government is more open to foreign investment, said Carlos Abadi, MBA ’85, CEO of Abadi & Co. Global Markets.

President Macri, a member of the center-right Republican Proposal party, provides a break from the Peronist party that dominated Argentinian politics for decades. The new ruling party has allowed the country to introduce a system of checks and balances with a strong commitment to fiscal austerity, Abadi said.

One new policy, freeing up the exchange rate of the Argentinian peso to the open market, has helped to curb inflation, which exceeded 30 percent in 2016. “Argentina once had one of Latin America’s largest middle classes,” Abadi said. But rampant inflation of recent years eroded gains made by the Argentinian middle class. “Argentina needs to maintain its level of subsidy to the poor and continue to push for economic growth.”

India looks to boost innovation

A five-member panel explored the issues in India, the world’s second largest nation and an economy seeking new ways to invigorate its place both in global markets and in its domestic marketplace. They discussed the need to promote innovation, build on successes in the information technology sector, streamline the government bureaucracy, and invest in education for India’s youth.

The Indian economy is among the fastest growing in the E20, according to the new Emerging Market Multinationals Report, with GDP growth of 6.8 percent in 2016 and expected to reach 7.2 percent in 2017 and 7.5 percent in 2018.

“The long-range prospects for India are very good, even better than China,” said Soumitra Dutta, dean of the SC Johnson School of Business. “India has opportunities that are huge.”

Among the keys to India’s future growth is its higher education system, which is graduating students who are increasingly staying in India instead of seeking work abroad. Indians who have studied abroad are coming back, too. India’s respect for competing ideas has encouraged new ideas to grab hold, said Kaushik Basu, C. Marks Professor of International Studies at Cornell and former chief economist of the World Bank. “India’s freedom of speech and media allows creativity to flourish,” he said. “It has created a social space for creativity, a space for new voices.”

However, barriers to Indian growth remain. The 2016 demonetization drive, intended to crack down on the shadow economy, led to severe cash shortages, protests, and strikes. While the impacts from that action will gradually dissipate, Dutta said, investment in Indian infrastructure and basic education for Indian children are pressing needs. And the nation’s sprawling bureaucracy also hampers business development. “India has not managed to update its bureaucracy,” Dutta said.

Sandiip Bhammer, MBA ’04, portfolio manager of the South-Asia Investment Fund, SPC, at DA Capital, wants India to spend more on research and development, improve its laws on intellectual property, and streamline the bureaucracy — which has sapped the energy of Indian entrepreneurs, he said. He recalled a lesson he learned while working as an analyst for Fidelity Investments: “Chinese companies were successful because of big government, while Indian companies were successful in spite of big government.”

Mark Wilson ’79, MBA ’80, of Briarcliff Manor, N.Y., who owns Jackburn Manufacturing, was among the Cornell alumni who came to Roosevelt Island for the daylong conference. His company makes custom wire forms and competes with Chinese imports, and he was well aware of the growing strength of Chinese manufacturers. He found the conference quite informative. “This has helped me gain a better understanding of the international business landscape — both as a citizen and for business opportunities,” he said.

All roads [will] lead to China

As China’s economy grows, so does its sphere of influence: Bin Li, chief of the economics section of the U.S. Chinese Embassy, shares his perspective on “Global Challenges: Perspectives on China.”

China achieved a GDP growth rate of 6.7 percent in 2016, notes the Emerging Market Multinationals Report 2017. Bin Li, chief of the economics section of the U.S. Chinese Embassy, highlighted the successes and inherent challenges China faces in sustaining such a high growth rate when he spoke on “Global Challenges: Perspectives on China” at the Emerging Markets Institute 2017 conference.

China’s economic growth — and its expansion into other Asian nations, Eastern Europe, and the Middle East — has focused on energy, transportation infrastructure, real estate, and agriculture. A key element is China’s One Belt One Road initiative, a huge foreign policy program launched in 2013 and focused on developing infrastructure and trade with nations along the original Silk Road connecting Central Asia, the Middle East, and Europe, as well as a southern maritime route through Southeast Asia. The prodigious plan involves 65 countries, 33 percent of the world’s wealth, and 60 percent of the world’s population.

Li said that state-owned businesses are taking the lead, with the China Transportation group working in Qatar, Pakistan, and Malaysia, while its railway company has invested in high-speed rail in Indonesia. “There are very bright spots for Chinese enterprises,” Li said. “We want the international community to know what our entities have done.”

China’s economic expansion is coupled with an openness to the international community and emphasizes creating friendly international relations through cultural exchanges and what Li called “soft power.” It also welcomes free trade.

“China is thinking more and more outward,” he said. “China is for internationalization, not protectionism.”

Growth hasn’t come without growing pains. Air pollution in its major cities, including Beijing, has sparked a growing environmental consciousness among Chinese government leaders, with China investing in power plants that burn natural gas instead of coal. China will consume 160 billion cubic meters of natural gas in 2017, compared to 700 billion cubic meters of natural gas consumed in the U.S. in 2014, Li said.

While China does not expect to reduce carbon emissions, it will burn less coal. Natural gas consumption will grow with the completion of a gas pipeline from Central Asia and completion of an agreement with the U.S. to purchase natural gas from Alaska.

“In previous days, all we cared about was profit,” Li said. “Given the smog in Beijing, the consciousness has increased on the environment and climate change.”

Pitting R&D vs. Price

B-school students address a Chinese challenge in the Corning Emerging Markets Case Competition.

The problems faced by a legacy American satellite company losing market share to a Chinese competitor were the focus of the inaugural Emerging Markets Institute conference case competition on November 10. Facing off that day were three teams of finalists representing the University of Maryland’s Robert H. Smith School of Business, Georgetown University’s McDonough School of Business, and the Cornell SC Johnson College of Business.

The Georgetown team devised the winning plan, which leveraged American strength in research and development to overcome the Chinese company’s price advantage. It focused on cutting-edge satellites for the defense and intelligence communities, which the Georgetown graduate students argued would be more willing to buy American-made products, citing national security concerns.

The Cornell team, which placed second, proposed developing personal satellites, which would cost between $3,000 and $10,000. The personal satellites could be launched into outer space for high schools and universities looking to create teachable moments with their own connections from outer space. Their company would break even in just two years, the students predicted.

Christian Laftchiev, MBA ’19, said the SC Johnson team had met over the previous two weeks to come up with its novel plan for the American firm that was losing market share to the state-owned Chinese company.

“We had to innovate,” said Laftchiev, who is an Emerging Markets Institute Fellow. “So we decided to do something that was fun.”